Funding Your Mobile App Idea

The mobile app development space is booming, with millions of apps launched every year. But while the potential rewards can be enormous, turning a mobile app idea into a reality requires significant funding. Whether you’re a first-time entrepreneur or a seasoned startup founder, securing financing for your mobile app idea can be a complex process.

In this blog, we will explore various funding strategies to help you secure the capital you need to bring your app idea to life. From crowdfunding and angel investors to venture capital, startup accelerators, and more, we’ll cover everything you need to know about funding your mobile app idea.

1. Understanding the Funding Landscape for Mobile Apps

Before diving into specific funding options, it’s essential to understand the broader landscape of app funding strategies. Depending on where you are in your startup journey, the type of funding you seek may vary. Are you still in the idea stage, or have you already developed a minimum viable product (MVP)? Are you looking to scale or simply validate your concept? The answers to these questions will influence which funding sources are most appropriate for your mobile app.

Some of the key funding options include:

- Angel Investors

- Venture Capital

- Crowdfunding

- App Development Grants

- Bootstrapping

Each funding method comes with its own set of advantages and disadvantages, as well as different levels of risk and control.

Read More : Cost of Mobile App Development for Startups

2. Crowdfunding for Mobile Apps

Crowdfunding has become an increasingly popular option for mobile app developers who want to raise capital without giving up equity or relying on traditional funding sources.

Platforms like Kickstarter and Indiegogo allow entrepreneurs to pitch their app ideas directly to the public, seeking small contributions from many individuals in exchange for early access to the product, exclusive features, or other rewards.

Pros:

- No Equity Dilution: You retain full ownership of your idea.

- Market Validation: Crowdfunding can validate your app concept before you invest significant time or money into development.

- Community Support: Building a community of backers who are emotionally invested in your success.

Cons:

- Time-Consuming Campaigns: Success is not guaranteed, and creating a compelling campaign can take considerable effort.

- Unpredictable: If you don’t reach your funding goal, you don’t receive any capital.

3. Angel Investors

Angel investors are high-net-worth individuals who provide early-stage funding in exchange for equity or convertible debt. This option is popular among startup founders who need a cash infusion to get their app off the ground. Unlike venture capitalists, angel investors typically invest in the very early stages and may provide more favorable terms.

How to Pitch an App Idea to Angel Investors:

- Create a Solid Business Plan: Demonstrate that you have a viable market for your app and a plan for scaling.

- Show the Potential for ROI: Angel investors are looking for high returns on their investments, so make sure you can show a clear path to profitability.

- Highlight Your Expertise: Investors are more likely to back an app if they trust the team behind it.

Pros:

- Flexible Terms: Angels often provide more flexible terms than venture capitalists.

- Mentorship: In addition to funding, angel investors can offer valuable industry insights and mentorship.

Cons:

- Equity Dilution: You’ll have to give up a portion of your company, and this could dilute your ownership.

- Finding the Right Investor: It can be challenging to find angel investors who are a good fit for your app idea.

Read More : MVP App Development for Startups

4. Venture Capital

If your app idea has already gained traction and you’re ready to scale, venture capital (VC) can provide the funding you need. VC firms typically invest larger sums of money in exchange for equity and a say in how the business is run. They are looking for high-growth potential and an exit strategy, usually through an acquisition or an IPO.

Key Considerations for VC Funding:

- Investor ROI Expectations: VCs expect high returns on their investments, and they often look for a quick exit (e.g., within 5-7 years).

- Equity vs. Debt Financing: With venture capital, you’ll typically be giving up equity in exchange for funding, unlike debt financing, where you borrow money and repay it over time.

Pros:

- Large Capital Infusion: Venture capital can provide the significant resources needed to develop, market, and scale your app.

- Networking Opportunities: VC firms often have extensive networks that can open doors for your business.

Cons:

- Loss of Control: Giving up equity means giving up some control over your business decisions.

- Pressure for Quick Returns: VCs often push for rapid growth and may not be as patient as other funding sources.

5. App Development Grants

Another way to fund your mobile app idea is through app development grants. Many government programs, non-profits, and even private organizations offer grants for innovation in technology and mobile app development. These grants are usually non-dilutive, meaning you don’t have to give up equity or pay back the funds.

How to Access App Development Grants:

- Research: Look for grants specifically aimed at app development or startups. Websites like Grants.gov and other local or national databases often list available opportunities.

- Eligibility: Make sure your app idea meets the criteria set by the granting organization.

Pros:

- No Equity Loss: Unlike other funding methods, you don’t have to give up any equity in your company.

- Non-Repayable Funds: Grants are usually non-repayable, which makes them an attractive option.

Cons:

- Highly Competitive: Grants can be difficult to secure due to limited funding and high competition.

- Limited Funding Amounts: Grants typically provide smaller amounts of funding compared to venture capital or angel investment.

6. Bootstrapping Your App

For some founders, bootstrapping is the preferred way to fund their app. Bootstrapping means using your own savings or revenue from other ventures to finance the app development process. This route offers total control over your app and doesn’t require giving up equity.

Pros:

- Complete Control: You retain full ownership and control over your app and business decisions.

- No Equity Loss: Unlike other funding options, you don’t have to give up any equity.

Cons:

- Financial Risk: You take on all the financial risk yourself, which can be daunting if things don’t go as planned.

- Limited Resources: Without external funding, your ability to scale quickly may be limited.

Choosing the Right Funding Strategy for Your Mobile App Idea

Securing funding for your Illinois Mobile App idea is one of the most critical steps in the startup journey. Each funding source—whether crowdfunding, angel investors, venture capital, startup accelerators, or bootstrapping—offers distinct advantages and challenges.

The key is to align your funding strategy with your business goals, the stage of development of your app, and your long-term vision for the company.

By exploring all your options and understanding the nuances of each, you can make an informed decision that gives your Illinois Mobile App the financial backing it needs to succeed.”

By exploring all your options and understanding the nuances of each, you can make an informed decision that gives your mobile app the financial backing it needs to succeed.

Read More : Mobile App Strategy for Startups

FAQs

1. How do I know when to seek funding for my app? You should seek funding when you have a clear business plan, a prototype or MVP of your app, and a strategy for scaling. The earlier you start, the more options you’ll have.

2. Is crowdfunding a viable option for all mobile app ideas? Crowdfunding works best for consumer-facing apps that have mass appeal. If your app solves a common problem or offers an innovative service, it’s more likely to attract backers.

3. What are the biggest challenges in securing venture capital for my mobile app? The biggest challenge is demonstrating your app’s scalability and market potential. VCs want to see that your app can snowball and provide high returns on investment.

4. Can I apply for an app development grant if I’m just starting out? Yes, some grants specifically aim at early-stage startups, especially those in tech and mobile app development. However, competition for grants can be tough.

5. What’s the difference between equity and debt financing? Equity financing involves giving up a share of ownership in exchange for funding, while debt financing requires you to repay the borrowed amount with interest, without giving up ownership.

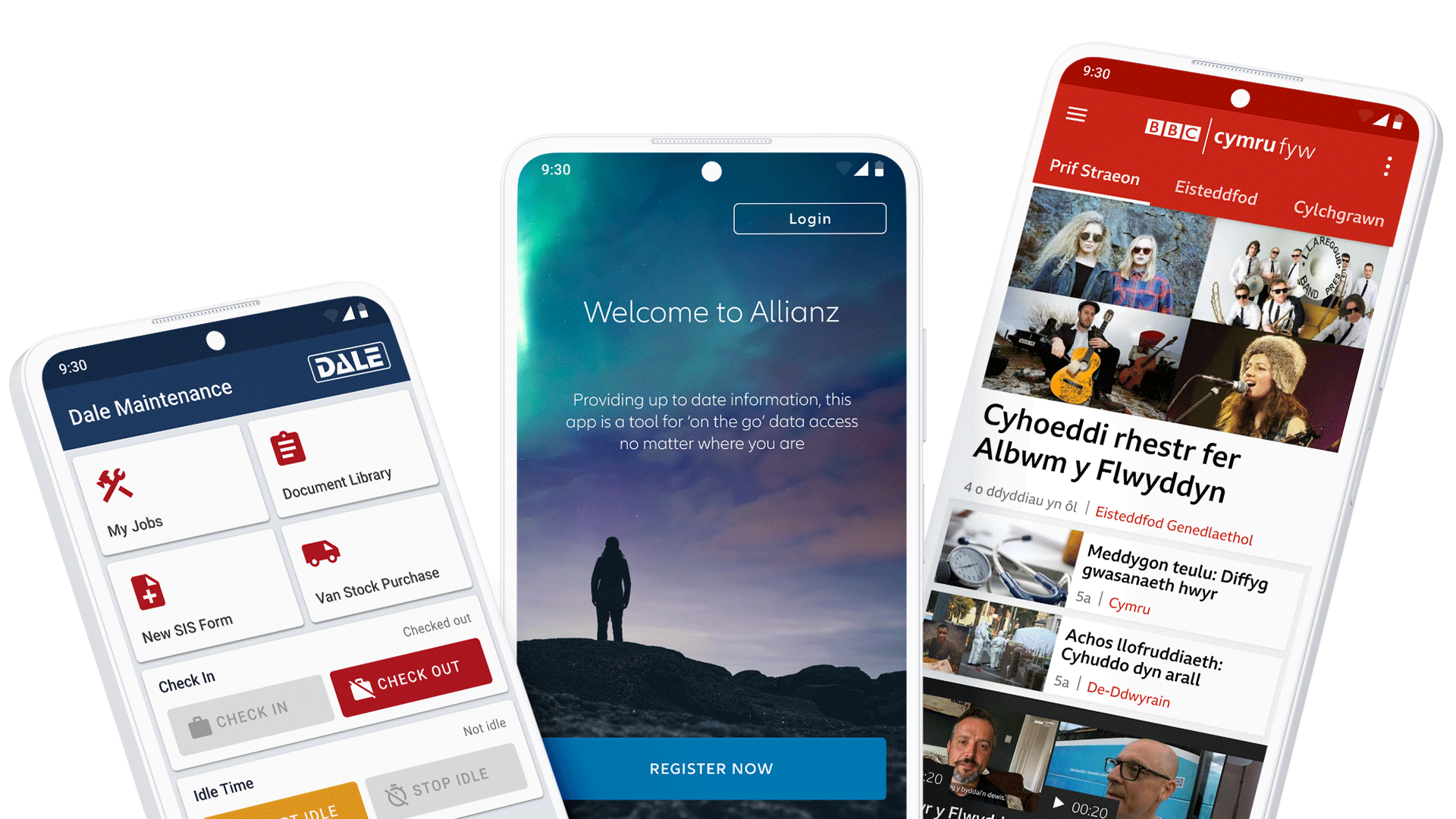

BuildBetterApp is a top-tier mobile app development company in Skokie and mobile app development company in Schaumburg, specializing in crafting innovative, high-performance applications for businesses of all sizes. Our expert team of developers, designers, and strategists is dedicated to delivering user-friendly, scalable, and feature-rich mobile solutions tailored to your unique business needs. Whether you need a custom iOS or Android app, enterprise mobility solutions, or cross-platform development, BuildBetterApp ensures cutting-edge technology and seamless user experience. Partner with us to turn your app ideas into reality and drive your business forward with powerful mobile solutions.